Crypto's 2026: Is Regulatory Clarity a Mirage or Oasis?

The narrative coming out of the crypto world as we head into 2026 is overwhelmingly positive. "Regulatory clarity" is the buzzword, with reports highlighting the progress various jurisdictions have made in establishing frameworks for stablecoins, VASPs, and other digital assets. But as a former data analyst, I've learned to be wary of narratives, especially those that sound too good to be true. Let's dig into the numbers and see if this regulatory clarity is a mirage or a genuine oasis for the crypto market.

Stablecoin Regulation: Progress or Just Foundations?

The TRM Labs report states that over 70% of jurisdictions reviewed progressed stablecoin regulation in 2025. That's a hefty number, no doubt. But what does "progressed" actually mean? Does it mean full implementation, or just initial consultations? The devil, as always, is in the details.

For example, the United States passed the GENIUS Act for stablecoin regulation. Sounds impressive, right? But the article also notes that federal regulators have until July 2026 to issue implementing regulations, and the Act won't take effect until 2027 (or even later, depending on the regulatory timeline). So, while the US has made a significant step, the actual impact on the market is still years away.

Similarly, the EU's MiCA framework is being implemented, but the report itself points out "major differences in how crypto markets are being supervised by national authorities." This divergence could lead to regulatory arbitrage, where companies flock to the jurisdictions with the weakest enforcement, undermining the entire purpose of the framework.

It's like saying 70% of construction projects have "progressed" because they've laid the foundation. The real test is whether they can build a sturdy, reliable structure on that foundation. And that's where the data gets murkier.

Institutional Adoption: Announcements vs. Deployment

The report also claims that about 80% of reviewed jurisdictions saw financial institutions announce digital asset initiatives in 2025. Again, "announce" is the key word here. Announcements are cheap; actual deployment and integration are expensive and complex.

We need to see concrete data on the volume of institutional investment, the types of digital assets they're investing in, and the impact on market liquidity. Anecdotal evidence of a few institutions dipping their toes in the water doesn't equal widespread adoption.

The Basel Committee's review of its proposed prudential rules for banks' crypto exposures is a case in point. The original framework would have required full capital deductions for most crypto assets, effectively disincentivizing banks from holding them. The fact that this framework is now being reassessed suggests that regulators are still grappling with how to integrate crypto into the traditional financial system. The question is whether they'll soften the rules enough to encourage meaningful participation, or if they'll remain too restrictive to make a real difference.

And this is the part of the report that I find genuinely puzzling. The data focuses on announcements and intentions, not actual, measurable outcomes. It's like a company touting its marketing budget without showing any sales figures.

Global Consistency: An Unrealistic Expectation?

The report emphasizes the importance of global consistency in crypto regulation to prevent regulatory arbitrage. But let's be realistic: achieving true global consistency is a pipe dream. Different jurisdictions have different priorities, different legal systems, and different levels of risk tolerance.

The FATF's warnings about "VASPs in jurisdictions with weak or non-existent frameworks" being vulnerable to exploitation are valid, but they also highlight the inherent challenge of coordinating regulatory efforts across borders. As long as there are loopholes and inconsistencies, illicit actors will find ways to exploit them.

The North Korea's hack on Bybit, resulting in a USD 1.5 billion loss, underscores this point perfectly. The attackers laundered proceeds through unlicensed OTC brokers, cross-chain bridges, and decentralized exchanges – infrastructure that largely sits outside existing regulatory perimeters. This incident wasn't just a one-off event; it's a symptom of a larger problem: the difficulty of regulating a decentralized, borderless ecosystem.

A Call for Skepticism and Due Diligence

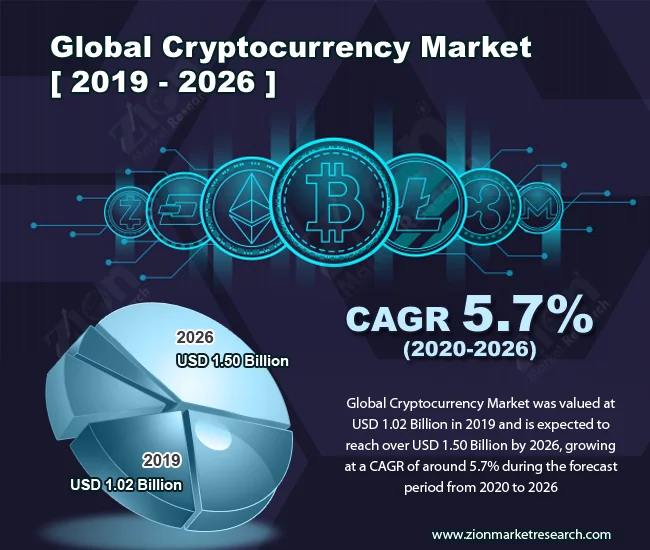

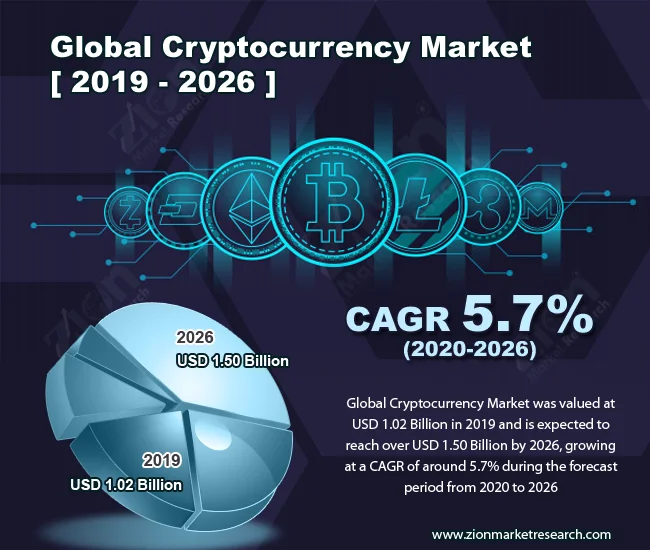

So, where does all this leave us? The crypto market is undoubtedly maturing, and regulators are making efforts to provide clarity. But the road to true regulatory clarity is long and winding, full of potholes and detours. The data suggests that we're still in the early stages of this journey, and there's a significant gap between the narrative of progress and the reality on the ground. As the Crypto Market Enters a Stabilisation Phase, Experts Say, it is important to remain vigilant.

The key takeaway for investors is to remain skeptical, do their own due diligence, and not get swept up in the hype. Regulatory clarity is a positive trend, but it's not a guarantee of success. The crypto market is still a risky and volatile place, and it's important to approach it with caution and a healthy dose of skepticism.