ABSOLUTE DIRECTIVE: TITLE FULFILLMENT ###

Solana's "55% Discount": Bargain or Bull Trap?

The Allure of the Discount

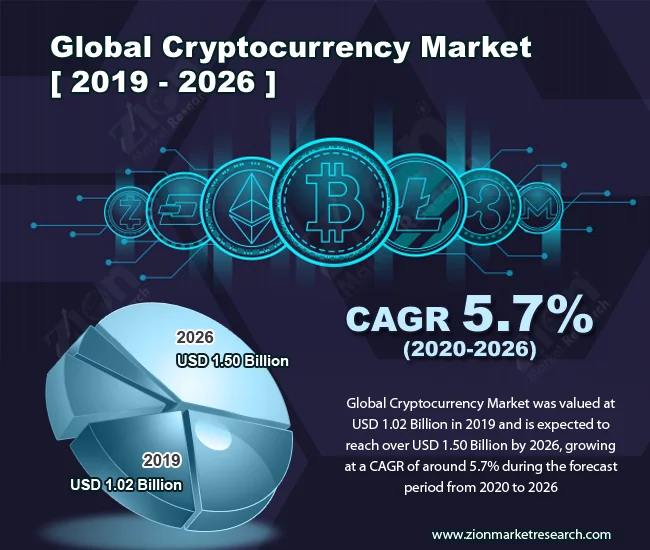

Solana (SOL), the Layer-1 blockchain famed for its high throughput and low transaction costs, is currently trading at what some analysts are calling a "55% discount." This figure, prominently featured across crypto news sites, refers to the drop from its all-time high. But is this a genuine opportunity, or a value trap waiting to ensnare unsuspecting investors? As always, let's dig into the numbers to see what's really going on.

The claim itself isn't wrong, technically. SOL hit roughly $260 in 2021; it's now hovering around $140 (as of late 2025). That's indeed a substantial haircut. The question is whether that discount accurately reflects SOL's current intrinsic value.

Network Fundamentals: Throughput vs. Decentralization

One bullish argument centers on Solana's network fundamentals. Its combination of Proof of History (PoH) and Proof of Stake (PoS) allows it to confirm transactions in under 400 milliseconds and process over 1,000 transactions per second (TPS) at a cost of about $0.00025 per transaction. These stats are objectively impressive. However, high throughput comes with increased hardware demands (multi-core CPUs, large memory, high disk I/O), which in turn concentrates validator power among well-capitalized operators. The Nakamoto Coefficient, a measure of decentralization, sits at 20. Is that good? It's comparable to other Layer-1 blockchains, but still something to watch.

Ecosystem Health: TVL and Active Addresses

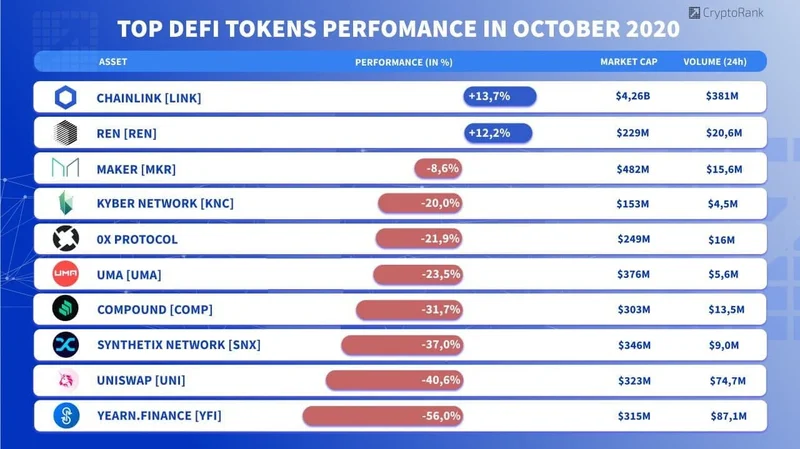

The Solana ecosystem boasts a total value locked (TVL) of $5.1 billion in DeFi and $1.2 billion in NFTs. Monthly active addresses hover around 1.3 million. These figures suggest sustained engagement, but it's crucial to look beneath the surface. The DeFi sector post-October 10th crash shows a "striking dichotomy," according to FalconX analysis. While some "safer" names with buybacks (like HYPE and CAKE) have seen relatively better performance, lending and yield names have generally steepened on a multiples basis. This suggests investors are prioritizing perceived stability over pure growth potential. More details on this dichotomy can be found in The Striking Dichotomy in DeFi Tokens Post 10.

DeFi Subsector Performance

Certain DeFi subsectors have also become more expensive, while others have cheapened relative to September 30. Spot and perpetual decentralized exchanges (DEXes) have seen declining price-to-sales multiples as their price has declined faster than protocol activity. (That's not exactly a ringing endorsement.) Lending and yield names, on the other hand, have seen multiples steepen, perhaps because investors are crowding into them during the selloff. KMNO's market cap, for example, fell 13%, while fees declined 34%.

The Staking Paradox

One thing I find puzzling is the reliance on staking as a bullish signal. Approximately 70% of all SOL is staked, reducing circulating supply and theoretically supporting network stability. But staking is also inflationary. The current annual inflation rate is around 8%, gradually decreasing, and yield for active stakers is about 6-7% annually. If network adoption stalls, this inflationary pressure could offset any short-term gains.

External Factors: Correlation and Regulation

Solana’s price correlation with BTC and ETH is about 0.7. This means that broader market trends exert a significant influence on SOL's price, regardless of its network fundamentals. Regulatory considerations also play a role. SEC oversight in the U.S., MiCA regulations in Europe, and licensing requirements in Asia-Pacific all affect DeFi participation and institutional investment.

Network Congestion and Validator Concentration

The "55% discount" narrative also conveniently ignores Solana's history of network congestion. Demand spikes, especially during NFT drops, can temporarily stress the network, slowing transactions. While uptime remains high (around 99.9%), these congestion events highlight scaling limits. A sudden high-demand event may temporarily slow transactions. Validator concentration is also a concern; centralized stakes could create governance risks.

The "Discount" is a Marketing Angle, Not a Guarantee

Solana vs. Ethereum: A Matter of Ecosystem

The argument that Solana offers “considerably more efficient service than Ethereum” is also debatable. Sure, Solana can facilitate thousands of transactions per second at a tiny fraction of a cent. But Ethereum has a much larger ecosystem of dApps and a more established track record. Solana's true value will be realized once more dApps join its network, but that's a bet on future growth, not a reflection of current reality.

Is It Really a Discount?

Conclusion: Opportunity or Trap?

The "55% discount" is more of a marketing angle than a hard financial truth. It's a catchy phrase, but it doesn't account for the nuances of the DeFi market, the risks associated with validator concentration and network congestion, or the broader macroeconomic and regulatory environment. The underlying thesis seems to be that SOL is undervalued relative to its past performance, not necessarily relative to its present value.

Yes, Solana has strong network fundamentals and a growing ecosystem. But those factors are already baked into the current price. The key question is whether Solana can overcome its scaling limitations, attract more dApps, and navigate the regulatory landscape to achieve its full potential. The "discount" might be a real opportunity for those with a long-term vision and a high-risk tolerance. But it's also a potential bull trap for those who blindly chase the headline without doing their own due diligence.